5 Ways Compare Travel Insurance

Introduction to Travel Insurance Comparison

When planning a trip, whether it’s for business or leisure, one of the most crucial aspects to consider is travel insurance. Travel insurance provides financial protection against unforeseen circumstances such as trip cancellations, medical emergencies, and lost luggage. With numerous travel insurance providers offering a wide range of policies, it can be overwhelming to choose the right one. In this article, we will explore the key factors to consider when comparing travel insurance options to ensure you make an informed decision.

Understanding Travel Insurance Policies

Before diving into the comparison, it’s essential to understand the types of travel insurance policies available. These include: - Single-Trip Policy: Covers a single trip from the departure date to the return date. - Multi-Trip Policy: Ideal for frequent travelers, this policy covers multiple trips within a specified period, usually a year. - Annual Policy: Offers coverage for an entire year, regardless of the number of trips taken. - Group Policy: Designed for groups traveling together, offering collective coverage.

5 Key Factors to Compare Travel Insurance

Comparing travel insurance policies involves evaluating several factors to ensure you select the policy that best meets your needs. Here are five key factors to consider:

Coverage Level: The first and foremost factor is the level of coverage provided by the policy. This includes the maximum amount the insurer will pay out in case of an event. Look for policies that offer comprehensive coverage, including trip cancellations, interruptions, delays, medical emergencies, and luggage loss or theft.

Policy Price: The cost of the policy is another critical factor. While it’s tempting to opt for the cheapest option, it’s essential to ensure that the policy provides adequate coverage. Sometimes, paying a bit more can offer better protection and peace of mind.

Exclusions and Limitations: Every policy comes with exclusions and limitations. It’s vital to understand what is not covered under the policy. For instance, some policies might not cover pre-existing medical conditions or adventures like skydiving. Ensure you review these carefully to avoid any surprises.

Provider Reputation and Customer Service: The reputation of the insurance provider and the quality of their customer service are also crucial. Look for providers with a good track record of claims handling and responsive customer support. You can check reviews, ask for referrals, or contact their customer service to gauge their responsiveness.

Flexibility and Add-Ons: Finally, consider the flexibility of the policy and the availability of add-ons. Some policies might offer the option to upgrade or add coverage for specific activities, like skiing or hiking. Flexibility can be beneficial, especially if your travel plans are subject to change.

Using Online Comparison Tools

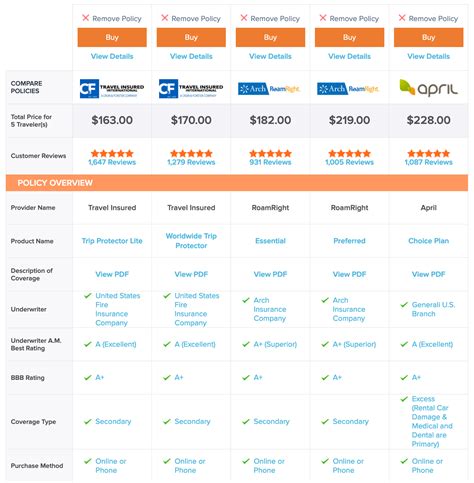

To simplify the comparison process, online tools and platforms can be incredibly useful. These tools allow you to input your travel details and compare policies from various providers side by side. They often highlight key features, coverage levels, and prices, making it easier to identify the best policy for your needs.

-table of Travel Insurance Comparison

| Policy | Coverage Level | Price | Exclusions | Provider Reputation |

|---|---|---|---|---|

| Single-Trip | Trip cancellation, medical emergencies | Varying | Pre-existing conditions | Good |

| Multi-Trip | Trip cancellation, medical emergencies, luggage loss | Higher than single-trip | Adventure activities | Excellent |

| Annual | Comprehensive, including trip cancellations and medical emergencies | Premium | Limited to specified travel dates | Very Good |

📝 Note: When comparing travel insurance policies, it's crucial to read the fine print and understand all the terms and conditions before making a decision.

In the end, selecting the right travel insurance policy involves careful consideration of several factors, including coverage level, policy price, exclusions, provider reputation, and flexibility. By understanding these elements and utilizing online comparison tools, travelers can make informed decisions to protect themselves against unforeseen events, ensuring a safer and more enjoyable travel experience. With the right policy in place, travelers can embark on their journeys with peace of mind, knowing they are adequately protected against life’s uncertainties.

What is the main purpose of travel insurance?

+

The main purpose of travel insurance is to provide financial protection against unforeseen circumstances such as trip cancellations, medical emergencies, and lost luggage.

How do I choose the right travel insurance policy?

+

To choose the right travel insurance policy, consider factors such as coverage level, policy price, exclusions, provider reputation, and flexibility. Utilizing online comparison tools can also help simplify the process.

What types of travel insurance policies are available?

+

There are several types of travel insurance policies, including single-trip, multi-trip, annual, and group policies, each designed to meet different travel needs and frequencies.