5 Tips Conditional Approval

Understanding Conditional Approval

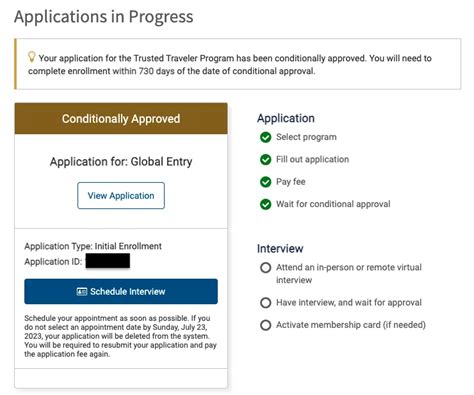

Conditional approval is a process used by lenders to approve a loan or credit application with certain conditions that must be met before the loan can be finalized. This process is commonly used in mortgage lending, credit card applications, and other types of loans. The goal of conditional approval is to ensure that the borrower meets the lender’s requirements and to minimize the risk of default. In this article, we will discuss 5 tips for navigating the conditional approval process.

Tips for Conditional Approval

When applying for a loan or credit, it’s essential to understand the conditional approval process and how to navigate it successfully. Here are 5 tips to help you through the process: * Review the conditions carefully: When you receive a conditional approval, review the conditions carefully to ensure you understand what is required of you. Make a list of the conditions and check them off as you complete them. * Gather required documents: The lender will typically require additional documentation to verify your income, employment, and creditworthiness. Gather these documents promptly to avoid delays in the process. * Respond to requests quickly: The lender may request additional information or clarification on certain aspects of your application. Respond to these requests quickly to keep the process moving forward. * Avoid making major changes: During the conditional approval process, avoid making major changes to your financial situation, such as quitting your job or applying for new credit. These changes can affect your creditworthiness and potentially derail the approval process. * Stay in touch with the lender: Keep in touch with the lender throughout the conditional approval process to ensure that everything is progressing smoothly. This will help you stay informed and address any issues that may arise.

The Importance of Timely Response

Responding promptly to the lender’s requests is crucial in the conditional approval process. Delays can lead to a longer processing time, and in some cases, the lender may even rescind the conditional approval. By responding quickly, you can help keep the process moving forward and increase the chances of a successful outcome.

Common Conditions for Conditional Approval

The conditions for conditional approval can vary depending on the lender and the type of loan. However, some common conditions include: * Verification of income and employment * Credit check and review of credit history * Appraisal of the property (for mortgage loans) * Review of financial statements and tax returns * Verification of identity and address

| Condition | Description |

|---|---|

| Verification of income and employment | The lender will verify your income and employment to ensure that you have a stable source of income to repay the loan. |

| Credit check and review of credit history | The lender will review your credit history to assess your creditworthiness and determine the level of risk associated with lending to you. |

| Appraisal of the property (for mortgage loans) | The lender will order an appraisal of the property to determine its value and ensure that it is sufficient to secure the loan. |

📝 Note: The conditions for conditional approval may vary depending on the lender and the type of loan. It's essential to review the conditions carefully and ask questions if you're unsure about any aspect of the process.

As you navigate the conditional approval process, it’s essential to stay organized, respond promptly to requests, and avoid making major changes to your financial situation. By following these tips and understanding the conditions for conditional approval, you can increase the chances of a successful outcome and secure the loan you need.

The key to a successful conditional approval process is to be prepared, responsive, and patient. By understanding the conditions and requirements, you can avoid delays and ensure that the process moves forward smoothly. Whether you’re applying for a mortgage, credit card, or other type of loan, the conditional approval process is an essential step in securing the funding you need. By following the tips outlined in this article, you can navigate the process with confidence and achieve your financial goals.