Federal Travel Regulations Guide

Introduction to Federal Travel Regulations

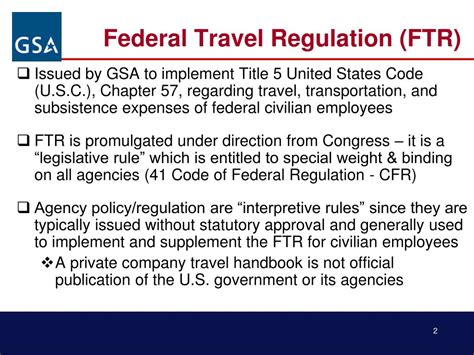

The federal travel regulations guide is a comprehensive set of rules and guidelines that govern travel expenses for federal employees. These regulations are established by the General Services Administration (GSA) and are designed to ensure that federal employees are reimbursed for their travel expenses in a fair and consistent manner. The regulations cover a wide range of topics, including per diem rates, travel allowances, and expense reporting requirements. In this guide, we will provide an overview of the federal travel regulations and highlight some of the key provisions that federal employees need to be aware of.

Per Diem Rates

Per diem rates are the daily allowances that federal employees receive to cover their lodging, meals, and incidental expenses while traveling on official business. The per diem rates vary depending on the location and time of year, and are established by the GSA. The rates are typically higher for areas with a high cost of living, such as major cities, and lower for areas with a lower cost of living. Federal employees can find the current per diem rates on the GSA website, which provides a lookup tool that allows employees to search for rates by location and date.

Travel Allowances

Travel allowances are the amounts that federal employees receive to cover their transportation, lodging, and meal expenses while traveling on official business. The travel allowances are typically based on the per diem rates, but may be adjusted based on the specific circumstances of the trip. For example, if an employee is traveling to a location with a high cost of living, they may receive a higher travel allowance to reflect the increased costs. The travel allowances are also subject to certain limits and restrictions, such as the requirement that employees use the most cost-effective mode of transportation.

Expense Reporting Requirements

Federal employees are required to submit expense reports to document their travel expenses and receive reimbursement. The expense reports must include detailed information about the expenses, such as the date, time, and location of the expense, as well as the amount and a brief description of the expense. Employees must also attach receipts to the expense report to support the expenses claimed. The expense reports are typically submitted through an online system, such as the Defense Travel System (DTS) or the Government Travel Charge Card.

Types of Travel

There are several types of travel that are subject to the federal travel regulations, including: * Temporary duty travel: This type of travel involves assignments that last for a short period of time, typically less than 6 months. * Permanent change of station travel: This type of travel involves assignments that require an employee to relocate to a new duty station. * Training travel: This type of travel involves assignments that are related to employee training and development. * Conference travel: This type of travel involves assignments that are related to conferences and meetings.

Reimbursable Expenses

The federal travel regulations specify which expenses are reimbursable and which are not. Reimbursable expenses include: * Transportation expenses: such as airfare, train fare, and rental car expenses. * Lodging expenses: such as hotel rooms and other temporary accommodations. * Meal expenses: such as breakfast, lunch, and dinner. * Incidental expenses: such as tips, taxes, and other miscellaneous expenses.

📝 Note: Employees should always check with their agency's travel office to determine which expenses are reimbursable and to ensure that they are following the proper procedures for submitting expense reports.

Non-Reimbursable Expenses

The federal travel regulations also specify which expenses are not reimbursable. Non-reimbursable expenses include: * Personal expenses: such as entertainment, recreation, and other personal activities. * Expenses related to personal travel: such as expenses incurred while on personal leave or vacation. * Expenses that are not reasonably related to the official business: such as expenses that are excessive or unreasonable.

Travel Cards

The federal government offers several types of travel cards that employees can use to pay for their travel expenses. The most common type of travel card is the Government Travel Charge Card, which is issued by the General Services Administration (GSA). The travel card can be used to pay for a variety of expenses, including transportation, lodging, and meals.

| Type of Travel Card | Description |

|---|---|

| Government Travel Charge Card | Issued by the GSA, this card can be used to pay for a variety of expenses, including transportation, lodging, and meals. |

| Defense Travel Card | Issued by the Department of Defense, this card is used to pay for travel expenses related to official business. |

| Department of State Travel Card | Issued by the Department of State, this card is used to pay for travel expenses related to official business. |

In summary, the federal travel regulations guide provides a comprehensive set of rules and guidelines that govern travel expenses for federal employees. The regulations cover a wide range of topics, including per diem rates, travel allowances, and expense reporting requirements. Federal employees must follow these regulations to ensure that they are reimbursed for their travel expenses in a fair and consistent manner.

What are the per diem rates for federal employees?

+

The per diem rates for federal employees vary depending on the location and time of year. Employees can find the current per diem rates on the GSA website, which provides a lookup tool that allows employees to search for rates by location and date.

What expenses are reimbursable under the federal travel regulations?

+

Reimbursable expenses include transportation expenses, lodging expenses, meal expenses, and incidental expenses. Employees should always check with their agency’s travel office to determine which expenses are reimbursable and to ensure that they are following the proper procedures for submitting expense reports.

How do I submit an expense report under the federal travel regulations?

+

Expense reports are typically submitted through an online system, such as the Defense Travel System (DTS) or the Government Travel Charge Card. Employees must include detailed information about the expenses, such as the date, time, and location of the expense, as well as the amount and a brief description of the expense. Employees must also attach receipts to the expense report to support the expenses claimed.