Seven Corners Travel Insurance Reviews

Introduction to Seven Corners Travel Insurance

When planning a trip, whether for business or leisure, one of the most critical considerations is travel insurance. Unexpected events like trip cancellations, medical emergencies, or lost luggage can significantly impact your journey. Seven Corners is a well-established company in the travel insurance industry, offering a variety of plans designed to protect travelers from such unforeseen circumstances. This review aims to delve into the details of Seven Corners travel insurance, exploring its features, benefits, and what sets it apart from other travel insurance providers.

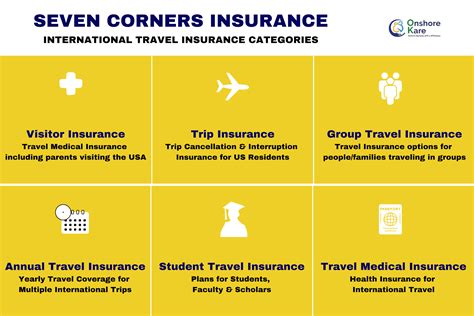

Overview of Seven Corners Travel Insurance Plans

Seven Corners offers a range of travel insurance plans tailored to meet the diverse needs of travelers. These plans include: - Liaison Travel Plus: Designed for international travel, this plan provides comprehensive coverage, including medical, evacuation, and travel-related benefits. - Liaison Travel Economy: A more budget-friendly option for international travel, offering essential medical and travel benefits. - RoundTrip: Geared towards domestic and international travel, this plan focuses on trip cancellation, interruption, and delay benefits, along with medical coverage. - Wander Frequent Traveler: Ideal for frequent travelers, this annual plan covers multiple trips throughout the year, offering medical and travel benefits.

Each plan comes with its set of benefits, including medical expenses, emergency evacuations, trip cancellations or interruptions, delays, and lost or stolen luggage. Understanding the specifics of each plan is crucial in selecting the one that best fits your travel needs and budget.

Key Features and Benefits

Seven Corners travel insurance plans boast several key features and benefits that make them attractive to travelers: - Comprehensive Medical Coverage: Including hospital stays, surgeries, doctor visits, and prescription medications, ensuring that you’re covered in case of medical emergencies. - Emergency Evacuation: Coverage for emergency medical evacuations to the nearest adequate medical facility or back to your home country, if necessary. - Trip Cancellation and Interruption: Reimbursement for non-refundable trip costs if your trip is cancelled or interrupted due to unforeseen circumstances. - 24⁄7 Travel Assistance: Access to around-the-clock assistance for help with travel-related issues, from flight changes to medical emergencies. - Customizable Plans: The ability to tailor your insurance plan to fit your specific travel needs, including the option to add additional coverage for items like adventure sports or rental car collisions.

Why Choose Seven Corners Travel Insurance?

Several factors make Seven Corners a preferred choice among travelers: - Experience and Reputation: With years of experience in the travel insurance industry, Seven Corners has built a reputation for reliability and customer satisfaction. - Flexibility in Plans: Offering a variety of plans means that travelers can find coverage that suits their type of travel, whether it’s a short domestic trip or an extended international journey. - Competitive Pricing: Seven Corners strives to provide affordable options without compromising on the quality of coverage, making travel insurance more accessible to a wider range of travelers. - Excellent Customer Service: Dedicated to providing assistance whenever needed, Seven Corners ensures that travelers receive the help they need promptly and efficiently.

Reviews and Ratings

Understanding the experiences of other travelers is invaluable when considering a travel insurance provider. Reviews of Seven Corners often highlight the company’s responsiveness, the comprehensiveness of its coverage, and the competitive pricing of its plans. However, as with any service, there may be varying levels of satisfaction depending on individual experiences and expectations.

| Plan | Medical Coverage | Trip Cancellation | Emergency Evacuation |

|---|---|---|---|

| Liaison Travel Plus | $100,000+ | 100% of trip cost | $500,000+ |

| Liaison Travel Economy | $50,000+ | 100% of trip cost | $250,000+ |

| RoundTrip | $50,000+ | 100% of trip cost | $250,000+ |

📝 Note: The coverage limits mentioned in the table are examples and may vary based on the plan and traveler's needs. It's essential to review the policy details before purchase.

Final Thoughts on Seven Corners Travel Insurance

In conclusion, Seven Corners travel insurance offers a comprehensive range of plans designed to cater to the diverse needs of travelers. With its flexible coverage options, competitive pricing, and commitment to customer service, Seven Corners stands out as a reliable choice in the travel insurance market. Whether you’re a frequent traveler or embarking on a single trip, considering the benefits and features of Seven Corners travel insurance can provide peace of mind and financial protection against the uncertainties of travel.

As travelers look to secure their trips with reliable insurance, understanding the specifics of what each plan offers is crucial. By weighing the benefits, coverage limits, and pricing, individuals can make informed decisions that meet their travel needs and budget. With Seven Corners, the goal is to ensure that your journey, whether for pleasure or business, is protected from unexpected events, allowing you to focus on what matters most – enjoying your travel experience.

What types of travel insurance plans does Seven Corners offer?

+

Seven Corners offers a variety of plans, including Liaison Travel Plus, Liaison Travel Economy, RoundTrip, and Wander Frequent Traveler, each designed to meet different travel needs and budgets.

Does Seven Corners travel insurance cover pre-existing medical conditions?

+

Seven Corners has specific policies and conditions regarding pre-existing medical conditions. It’s crucial to review the policy details and consult with a representative to understand the coverage and any limitations.

How do I file a claim with Seven Corners travel insurance?

+

To file a claim, contact Seven Corners directly through their customer service number or visit their website for detailed instructions and required documentation. Prompt notification and thorough documentation are key to a smooth claims process.