5 Tips Travel Guard

Introduction to Travel Guard

When planning a trip, whether for business or leisure, it’s essential to consider the unexpected events that could occur, such as trip cancellations, medical emergencies, or travel delays. This is where travel insurance, often referred to as a travel guard, comes into play. Travel guard is designed to protect travelers from financial losses due to unforeseen circumstances. In this article, we will delve into the world of travel guard, exploring its benefits, types, and how to choose the right policy for your needs.

Understanding Travel Guard Benefits

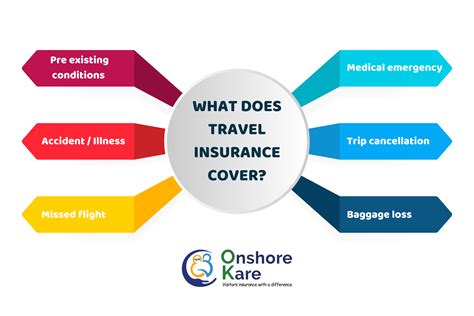

Travel guard offers a myriad of benefits that can provide peace of mind and financial security during your travels. Some of the key benefits include: - Trip Cancellation Insurance: Reimburses you for pre-paid, non-refundable expenses if you need to cancel your trip due to a covered reason. - Medical Expense Coverage: Covers medical expenses incurred while traveling, including hospital stays, doctor visits, and emergency evacuations. - Travel Delay Benefits: Provides reimbursement for meals, lodging, and other expenses if your trip is delayed due to a covered reason. - Baggage Insurance: Offers coverage for lost, stolen, or damaged luggage and personal effects.

Types of Travel Guard Policies

There are various types of travel guard policies available, catering to different travel needs and preferences. These include: - Single-Trip Policies: Ideal for one-off trips, providing coverage for a single journey. - Multi-Trip Policies: Suitable for frequent travelers, offering coverage for multiple trips within a specified period. - Annual Policies: Provides year-round coverage for all trips taken within a 12-month period. - Group Travel Policies: Designed for groups of travelers, often offering discounted rates for bulk coverage.

5 Tips for Choosing the Right Travel Guard

Selecting the right travel guard policy can be overwhelming, given the numerous options available. Here are five tips to help you make an informed decision: 1. Assess Your Needs: Consider the type of trip, destination, and activities involved to determine the level of coverage required. 2. Compare Policies: Research and compare different travel guard policies, looking at coverage limits, deductibles, and exclusions. 3. Check the Provider’s Reputation: Ensure the insurance provider is reputable, with a good claims payout history and excellent customer service. 4. Understand the Policy Details: Carefully read and understand the policy terms, including what is covered, what is not, and any conditions that may apply. 5. Consider Additional Benefits: Look for policies that offer additional benefits, such as 24⁄7 emergency assistance, travel advisories, and concierge services.

How to Purchase Travel Guard

Purchasing travel guard is relatively straightforward and can often be done online. Here are the steps to follow: - Research Providers: Look for travel insurance providers that offer policies suitable for your travel plans. - Get Quotes: Obtain quotes from different providers to compare prices and coverage. - Read Policy Documents: Carefully read the policy documents to ensure you understand what is covered and what is not. - Purchase the Policy: Once you’ve selected a policy, you can typically purchase it online or over the phone. - Review and Understand Your Policy: After purchasing, review your policy documents to ensure you understand the coverage and any requirements.

📝 Note: Always keep your policy documents and contact information for your insurance provider handy during your travels.

Conclusion and Final Thoughts

In conclusion, travel guard is an essential component of travel planning, offering financial protection and peace of mind against unforeseen events. By understanding the benefits, types, and how to choose the right policy, you can ensure your travels are secure and enjoyable. Remember, the key to selecting the right travel guard is to assess your needs, compare policies, and understand the policy details. With the right travel guard in place, you can focus on what matters most – enjoying your travels.

What is travel guard, and why is it important?

+

Travel guard, or travel insurance, is important because it protects travelers from financial losses due to unforeseen circumstances such as trip cancellations, medical emergencies, or travel delays, providing peace of mind and financial security during travels.

How do I choose the right travel guard policy for my needs?

+

To choose the right travel guard policy, assess your travel needs, compare different policies, check the provider’s reputation, understand the policy details, and consider additional benefits. This ensures you get the coverage that best suits your travel plans.

What are the common types of travel guard policies available?

+

The common types of travel guard policies include single-trip policies for one-off trips, multi-trip policies for frequent travelers, annual policies for year-round coverage, and group travel policies for groups of travelers. Each type caters to different travel needs and preferences.