Travel Insurance Comparisons Made Easy

Introduction to Travel Insurance

Traveling, whether for leisure or business, can be an exhilarating experience. However, it also comes with its set of uncertainties and risks. One of the most effective ways to mitigate these risks is by purchasing travel insurance. Travel insurance is designed to cover unforeseen circumstances that may arise before or during your trip, such as trip cancellations, medical emergencies, or lost luggage. With so many travel insurance providers and policies available, comparing them can seem like a daunting task. In this article, we will guide you through the process of comparing travel insurance policies to ensure you find the best coverage for your needs.

Understanding Travel Insurance Policies

Before diving into comparisons, it’s essential to understand what travel insurance policies typically cover. Most policies include: - Trip Cancellation: Reimburses you for prepaid, non-refundable trip costs if you need to cancel your trip due to a covered reason. - Trip Interruption: Covers additional expenses if your trip is interrupted due to a covered reason. - Medical Expenses: Pays for medical treatment if you become ill or injured during your trip. - Travel Delay: Provides reimbursement for meals and accommodations if your flight is delayed. - Lost, Stolen, or Damaged Baggage: Covers the cost of replacing essential items if your baggage is lost, stolen, or damaged.

Factors to Consider When Comparing Travel Insurance

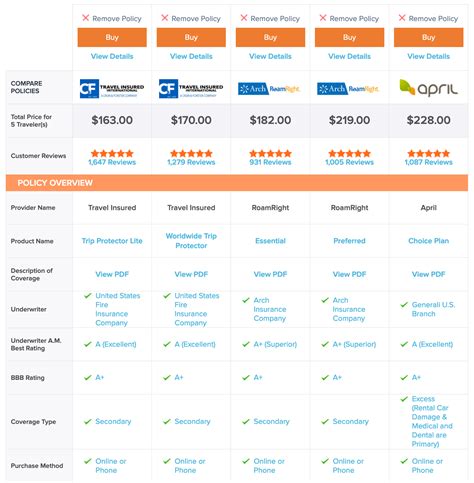

When comparing travel insurance policies, several factors should be taken into consideration to ensure you choose the policy that best suits your travel plans and budget. These factors include: - Policy Coverage: Look at what is covered under each policy, including the types of trips, destinations, and activities. - Policy Limits: Check the maximum amount the insurer will pay for each type of coverage. - Deductible: Understand how much you must pay out-of-pocket before the insurance kicks in. - Pre-existing Conditions: If you have any pre-existing medical conditions, ensure the policy covers them. - Cost: Compare the premiums of different policies, considering both the cost and the coverage provided. - Provider Reputation: Research the insurance provider’s reputation for customer service, claims processing, and financial stability.

How to Compare Travel Insurance Policies Effectively

Comparing travel insurance policies effectively requires a systematic approach: - Research Providers: Start by identifying reputable travel insurance providers. - Review Policy Details: Look closely at what each policy covers, the policy limits, deductibles, and any exclusions. - Use Comparison Tools: Many insurance comparison websites offer tools that allow you to compare policies side by side based on your specific travel plans. - Read Reviews: Check reviews from other customers to get an idea of the insurer’s reliability and service quality. - Contact Providers: If you have specific questions or need further clarification, don’t hesitate to contact the insurance providers directly.

Common Mistakes to Avoid

When comparing and purchasing travel insurance, there are common mistakes to be aware of and avoid: - Not Reading the Fine Print: Understand what is covered and what is not to avoid surprises later. - Assuming All Policies Are the Same: Each policy is unique, so compare them carefully. - Buying Based Solely on Price: While cost is an important factor, it shouldn’t be the only consideration. Ensure the policy provides adequate coverage. - Not Considering Pre-existing Conditions: If you have a pre-existing condition, make sure it is covered under the policy.

🚨 Note: Always review the policy's terms and conditions carefully before making a purchase, and consider seeking advice from a licensed insurance professional if you're unsure about any aspect of the policy.

Staying Informed

The travel insurance landscape is constantly evolving, with new policies and providers emerging regularly. Staying informed about the latest developments and changes in travel insurance can help you make the most informed decisions for your travel needs. Follow travel insurance blogs, and news outlets to stay up-to-date.

| Policy Type | Coverage | Cost |

|---|---|---|

| Basic | Trip cancellation, medical expenses | $20-$50 |

| Premium | Trip cancellation, medical expenses, trip interruption, travel delay | $50-$100 |

| Comprehensive | All of the above plus additional benefits like baggage insurance | $100-$200 |

In the end, finding the right travel insurance policy involves careful consideration of your travel plans, budget, and the types of coverage you need. By understanding what travel insurance covers, considering key factors, and avoiding common mistakes, you can make an informed decision that protects your travels and provides peace of mind.

What is travel insurance, and why do I need it?

+

Travel insurance is a type of insurance that covers unexpected medical or travel-related expenses while you are traveling. You need it to protect against unforeseen circumstances that could otherwise lead to significant financial losses.

How do I choose the best travel insurance policy for my trip?

+

To choose the best travel insurance policy, consider factors such as the type of trip, destination, policy coverage, deductibles, and the provider’s reputation. It’s also beneficial to compare different policies and read reviews from other customers.

Can I purchase travel insurance after I’ve already booked my trip?

+

Yes, you can purchase travel insurance after booking your trip, but it’s generally recommended to buy it as soon as possible after making your travel arrangements. This is because some benefits, like trip cancellation insurance, are only available if you purchase the policy within a certain timeframe after booking your trip.