Travel Insurance Review Guide

Introduction to Travel Insurance

Traveling, whether for leisure or business, comes with its own set of risks and uncertainties. From unexpected trip cancellations to medical emergencies in foreign lands, the possibilities for things to go wrong are numerous. This is where travel insurance steps in, providing a safety net that can help mitigate the financial and emotional impacts of such unforeseen events. In this comprehensive guide, we will delve into the world of travel insurance, exploring its types, benefits, and how to choose the right policy for your needs.

Understanding Travel Insurance

Travel insurance is designed to cover travelers against a range of risks that may arise before or during their trip. These risks can include trip cancellations or interruptions, medical emergencies, travel delays, and loss or theft of personal belongings. Policies can vary significantly in terms of what they cover, the levels of coverage, and the cost. It’s crucial to understand the specifics of any policy before purchasing to ensure it meets your travel needs and budget.

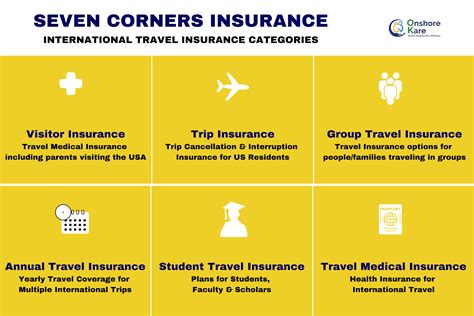

Types of Travel Insurance

There are several types of travel insurance policies available, catering to different types of travelers and trips: - Single-Trip Travel Insurance: Covers a single trip and is ideal for infrequent travelers. - Multi-Trip Travel Insurance: Suitable for frequent travelers, as it covers multiple trips within a year. - Long-Stay Travel Insurance: Designed for travelers embarking on extended trips, often exceeding 30 days. - Annual Travel Insurance: Provides coverage for all trips taken within a year, with each trip usually having a duration limit. - Group Travel Insurance: Covers groups of people traveling together, often more cost-effective than individual policies.

Benefits of Travel Insurance

The benefits of having travel insurance are multifaceted: - Financial Protection: Against unforeseen medical or travel-related expenses. - Trip Cancellation: Reimburses prepaid trip costs if the trip is cancelled due to covered reasons. - Medical Expenses: Covers medical treatment, hospital stays, and sometimes even evacuations. - Travel Delays: Provides compensation for flight delays, missed connections, or travel interruptions. - Baggage and Personal Effects: Covers loss, theft, or damage to luggage and personal items. - 24⁄7 Assistance: Many providers offer round-the-clock emergency assistance services.

Choosing the Right Travel Insurance

Selecting the right travel insurance policy involves considering several factors: - Destination: Certain destinations may have specific requirements or risks that your policy should cover. - Type of Travel: Adventure travel, for instance, may require additional coverage for risky activities. - Duration of Trip: Longer trips may require more comprehensive coverage. - Age and Health: Older travelers or those with pre-existing medical conditions may need specialized coverage. - Budget: Balancing the cost of the policy with the level of coverage needed.

What to Look for in a Policy

When reviewing travel insurance policies, pay attention to: - Coverage Limits: Ensure the policy’s coverage limits are sufficient for your needs. - Deductibles: Understand how much you’ll need to pay out of pocket for claims. - Pre-existing Conditions: If you have a pre-existing condition, check if it’s covered and under what terms. - Exclusions: Be aware of what the policy does not cover. - Provider Reputation: Research the insurance provider’s reputation for claims handling and customer service.

How to Purchase Travel Insurance

Purchasing travel insurance can be done through various channels: - Directly from Insurers: Buying directly from the insurance company’s website or office. - Travel Agents: Often, travel agents can include insurance as part of the travel package. - Online Travel Platforms: Some platforms allow you to compare and purchase travel insurance alongside booking your travel. - Insurance Brokers: Specialized brokers can help find the right policy for your specific needs.

💡 Note: Always read the policy documents carefully and ask questions if you're unsure about any aspect of the coverage.

Claims Process

Understanding the claims process is vital: - Notify Your Insurer: Inform your insurance provider as soon as possible after an incident. - Gather Documentation: Collect all relevant documents, such as receipts, medical reports, and police reports. - Submit Your Claim: Follow the insurer’s instructions for submitting a claim. - Follow Up: If necessary, follow up with your insurer to check on the status of your claim.

Conclusion

In summary, travel insurance is a vital component of travel planning, offering protection against a wide array of risks. By understanding the types of policies available, their benefits, and how to choose the right one, travelers can embark on their journeys with greater peace of mind. Remember, the key to making the most of travel insurance is selecting a policy that aligns with your specific travel plans and needs.

What is travel insurance, and why is it important?

+

Travel insurance is a type of insurance that covers risks associated with traveling, such as trip cancellations, medical emergencies, and loss or theft of personal belongings. It’s important because it provides financial protection against unforeseen events, helping travelers avoid significant out-of-pocket expenses.

How do I choose the right travel insurance policy for my needs?

+

Choosing the right policy involves considering your destination, type of travel, trip duration, age, health, and budget. It’s also crucial to review the policy’s coverage limits, deductibles, pre-existing condition clauses, exclusions, and the provider’s reputation for claims handling and customer service.

What should I do if I need to make a claim on my travel insurance?

+

If you need to make a claim, notify your insurer as soon as possible, gather all relevant documentation, and follow the insurer’s instructions for submitting a claim. Be prepared to provide detailed information about the incident and keep a record of all communications with your insurer.