Travel Insurance US Made Easy

Introduction to Travel Insurance in the US

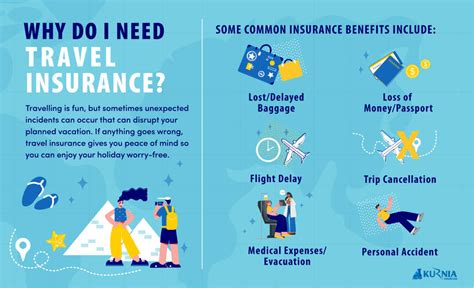

When planning a trip, whether domestically or internationally, one of the most crucial aspects to consider is travel insurance. Travel insurance provides financial protection against unforeseen circumstances such as trip cancellations, medical emergencies, delays, and lost luggage. The US travel insurance market offers a wide range of policies tailored to different types of travelers, including leisure travelers, adventure seekers, and business travelers. Understanding the basics of travel insurance and how to choose the right policy can make a significant difference in ensuring a stress-free and enjoyable trip.

Types of Travel Insurance

Travel insurance policies can be broadly categorized into several types, each designed to address specific needs: - Single-Trip Travel Insurance: Ideal for one-off trips, providing coverage from the start to the end of the trip. - Multi-Trip Travel Insurance: Suitable for frequent travelers, offering coverage for multiple trips within a year. - Annual Travel Insurance: Provides coverage for all trips taken within a year, often with a limit on the duration of each trip. - Long-Stay Travel Insurance: Designed for individuals staying abroad for an extended period, often exceeding 30 days. - Group Travel Insurance: Offers coverage for groups traveling together, which can be more cost-effective than individual policies.

Key Components of Travel Insurance Policies

A typical travel insurance policy includes several key components:

- Trip Cancellation Insurance: Reimburses the traveler for prepaid, non-refundable expenses if the trip is cancelled due to a covered reason.

- Trip Interruption Insurance: Provides reimbursement for the unused portion of the trip and for the cost of returning home if the trip is interrupted due to a covered reason.

- Medical Expense Coverage: Covers medical expenses incurred during the trip, including hospital stays, doctor visits, and emergency medical evacuations.

- Travel Delay Insurance: Offers reimbursement for additional expenses incurred due to travel delays, such as the cost of accommodations and meals.

- Baggage and Personal Effects Coverage: Reimburses the traveler for lost, stolen, or damaged luggage and personal effects during the trip.

Choosing the Right Travel Insurance Policy

Selecting the right travel insurance policy can be overwhelming, given the numerous options available. Here are some tips to help make the decision easier: - Assess Your Needs: Consider the type of trip, the destination, the duration, and the activities you plan to engage in. This will help in determining the level of coverage required. - Compare Policies: Research and compare different policies from various providers to find the one that best matches your needs and budget. - Read the Fine Print: Understand what is covered and what is not. Pay particular attention to the policy’s exclusions and limitations. - Check the Provider’s Reputation: Look for providers with a good reputation for customer service and claims handling.

Purchasing Travel Insurance

Travel insurance can be purchased directly from insurance companies, through travel agents, or online. It’s essential to buy travel insurance as soon as possible after booking the trip to ensure coverage for pre-departure trip cancellations. The cost of travel insurance varies based on factors such as the type of policy, the destination, the duration of the trip, and the age and health of the traveler.

| Factor | Description |

|---|---|

| Type of Policy | The cost varies depending on whether it's a single-trip, multi-trip, or annual policy. |

| Destination | Trips to high-risk areas or countries with high medical costs may increase the premium. |

| Duration of the Trip | Longer trips generally cost more to insure than shorter ones. |

| Age and Health of the Traveler | Older travelers or those with pre-existing medical conditions may face higher premiums. |

📝 Note: It's crucial to disclose any pre-existing medical conditions when purchasing travel insurance to ensure that you are adequately covered.

Filing a Claim

In the event that something goes wrong during the trip, filing a claim with the insurance provider is necessary to receive reimbursement. It’s essential to keep all receipts and documentation related to the claim, as these will be required by the insurance company. Understanding the claims process and having all necessary documents ready can help streamline the process and reduce stress.

To summarize, travel insurance is a vital component of trip planning that provides protection against unexpected events. By understanding the different types of policies available, the key components of a policy, and how to choose the right one, travelers can ensure they have the necessary coverage for a secure and enjoyable trip.

What is the primary purpose of travel insurance?

+

The primary purpose of travel insurance is to provide financial protection against unforeseen circumstances such as trip cancellations, medical emergencies, delays, and lost luggage.

How do I choose the right travel insurance policy for my trip?

+

To choose the right travel insurance policy, assess your needs, compare policies from different providers, read the fine print, and check the provider's reputation.

What factors affect the cost of travel insurance?

+

The cost of travel insurance is affected by factors such as the type of policy, destination, duration of the trip, and the age and health of the traveler.

Travel insurance offers peace of mind for travelers, allowing them to enjoy their trips without worrying about the financial implications of unforeseen events. Whether you’re a seasoned traveler or embarking on your first adventure, understanding the ins and outs of travel insurance is key to making informed decisions about your trip. By considering the types of policies available, understanding what is covered, and knowing how to choose the right policy, you can ensure that your travels are not only enjoyable but also protected against life’s uncertainties.