Travel Insurance Coverage Explained

Introduction to Travel Insurance

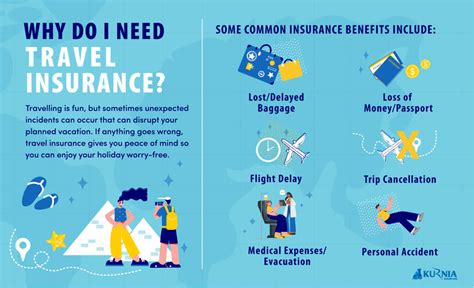

Traveling, whether for leisure or business, comes with its own set of risks and uncertainties. From flight cancellations and delays to medical emergencies and lost luggage, the potential for unexpected events to disrupt your trip is ever-present. This is where travel insurance comes into play, offering a safety net that can help mitigate the financial impact of such events. In this article, we will delve into the world of travel insurance, exploring the various types of coverage available, how to choose the right policy, and what to expect when filing a claim.

Types of Travel Insurance Coverage

Travel insurance policies can vary widely in terms of the coverage they offer. Some of the most common types of coverage include: - Trip Cancellation Insurance: Reimburses you for prepaid, non-refundable trip costs if you need to cancel your trip due to a covered reason such as illness, injury, or death of a family member. - Trip Interruption Insurance: Provides reimbursement for the unused portion of your trip and for the cost of returning home if your trip is interrupted due to a covered reason. - Medical Insurance: Covers medical expenses incurred while traveling, including doctor visits, hospital stays, and emergency medical evacuations. - Travel Delay Insurance: Offers reimbursement for meals, lodging, and other expenses if your trip is delayed due to a covered reason such as flight delays or cancellations. - Baggage Insurance: Reimburses you for lost, stolen, or damaged luggage and personal effects.

Choosing the Right Travel Insurance Policy

With so many travel insurance options available, choosing the right policy can seem daunting. Here are some tips to consider: - Assess Your Risks: Consider the type of travel you will be doing, the length of your trip, and any pre-existing medical conditions you may have. - Read Policy Documents Carefully: Understand what is covered and what is not, including any deductibles, limits, and exclusions. - Check the Provider’s Reputation: Look for insurance providers with a good reputation for paying claims promptly and efficiently. - Consider Additional Coverage Options: Depending on your needs, you may want to consider additional coverage options such as adventure travel insurance or travel insurance for cruises.

Filing a Travel Insurance Claim

If you need to file a claim with your travel insurance provider, here are some steps to follow: - Notify Your Provider Immediately: Most insurance providers require you to notify them as soon as possible after an incident occurs. - Gather Supporting Documentation: This may include receipts, medical records, and police reports, depending on the nature of your claim. - Submit Your Claim: Follow the instructions provided by your insurance provider to submit your claim, and be patient as the claims process can take some time.

📝 Note: It's essential to keep detailed records of all correspondence with your insurance provider, including dates, times, and the names of representatives you speak with.

Benefits of Travel Insurance

While travel insurance may seem like an unnecessary expense, it can provide significant benefits in the event of an unexpected incident. Some of the key benefits of travel insurance include: - Financial Protection: Travel insurance can help protect you against significant financial losses in the event of trip cancellations, interruptions, or medical emergencies. - Peace of Mind: Knowing that you have travel insurance can provide peace of mind, allowing you to enjoy your trip without worrying about the potential risks. - 24⁄7 Assistance: Many travel insurance providers offer 24⁄7 assistance, providing you with help and support whenever you need it.

Common Exclusions and Limitations

While travel insurance can provide significant benefits, it’s essential to understand what is not covered. Some common exclusions and limitations include: - Pre-existing Medical Conditions: Many travel insurance policies exclude pre-existing medical conditions, unless you purchase a waiver or have a policy that covers such conditions. - Adventure Activities: Certain adventure activities, such as skydiving or rock climbing, may be excluded from coverage or require an additional premium. - Travel to High-Risk Areas: Travel to high-risk areas, such as countries with travel warnings, may be excluded from coverage or require an additional premium.

| Coverage Type | Description |

|---|---|

| Trip Cancellation | Reimburses prepaid, non-refundable trip costs if you need to cancel your trip |

| Trip Interruption | Provides reimbursement for the unused portion of your trip and for the cost of returning home |

| Medical Insurance | Covers medical expenses incurred while traveling |

To summarize, travel insurance is a vital component of any trip, providing financial protection and peace of mind in the event of unexpected incidents. By understanding the various types of coverage available, choosing the right policy, and knowing how to file a claim, you can ensure that your trip is protected against the unexpected. Whether you’re traveling for leisure or business, travel insurance is an essential investment that can help you enjoy your trip with confidence.

What is travel insurance, and why do I need it?

+

Travel insurance is a type of insurance that provides financial protection against unexpected events such as trip cancellations, interruptions, and medical emergencies. You need travel insurance to protect yourself against significant financial losses and to enjoy peace of mind while traveling.

How do I choose the right travel insurance policy?

+

To choose the right travel insurance policy, assess your risks, read policy documents carefully, check the provider’s reputation, and consider additional coverage options. It’s also essential to understand what is covered and what is not, including any deductibles, limits, and exclusions.

What is the process for filing a travel insurance claim?

+

To file a travel insurance claim, notify your provider immediately, gather supporting documentation, and submit your claim. Be patient as the claims process can take some time, and keep detailed records of all correspondence with your insurance provider.