Traveling

What is Travel Insurance

Introduction to Travel Insurance

Travel insurance is a type of insurance that covers unforeseen medical or travel-related expenses while traveling, either within one’s own country or internationally. It is designed to provide financial protection against unexpected events such as trip cancellations, medical emergencies, or losses incurred during travel. Travel insurance can be purchased for individual trips or as an annual policy for frequent travelers.

Types of Travel Insurance

There are several types of travel insurance policies available, each catering to different needs and types of travel. Some of the most common types include: - Single-Trip Travel Insurance: Covers a single trip and is ideal for infrequent travelers. - Multi-Trip Travel Insurance: Covers multiple trips within a year and is suitable for frequent travelers. - Annual Travel Insurance: Provides coverage for all trips taken within a year, often with a limit on the duration of each trip. - Group Travel Insurance: Designed for groups of people traveling together, offering a cost-effective way to ensure all members are covered. - Long-Stay Travel Insurance: Suitable for individuals who plan to stay abroad for an extended period, often exceeding the typical 30-90 day limit of standard travel insurance policies.

What Does Travel Insurance Cover?

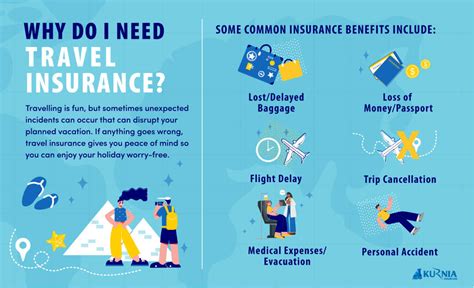

Travel insurance policies can vary significantly in what they cover, but most include some or all of the following: - Trip Cancellation: Reimburses the traveler for pre-paid, non-refundable travel expenses if they must cancel their trip due to a covered reason. - Trip Interruption: Covers additional expenses incurred to return home early or rejoin a trip due to a covered reason. - Medical Expenses: Pays for emergency medical and dental care while traveling. - Emergency Medical Evacuation: Covers the cost of transportation to a medical facility if immediate care is not available locally. - Travel Delay: Provides compensation for meals and accommodations if a trip is delayed due to a covered reason. - Lost, Stolen, or Damaged Luggage: Reimburses for luggage and personal effects that are lost, stolen, or damaged during the trip. - Travel Documents: Covers the replacement cost of important documents such as passports or visas if they are lost or stolen.

Benefits of Travel Insurance

The benefits of having travel insurance are numerous and include: - Financial Protection: Against unforeseen medical or travel-related expenses. - Peace of Mind: Knowing that you have a financial safety net in case something goes wrong. - Emergency Assistance: Many travel insurance providers offer 24⁄7 emergency assistance services. - Flexibility: Some policies allow for changes to your itinerary or even cancellation of your trip for any reason, with varying levels of reimbursement.

How to Choose the Right Travel Insurance

Choosing the right travel insurance policy involves several steps: - Assess Your Needs: Consider the type of trip, destination, duration, and any specific activities you plan to undertake. - Check Policy Details: Look at what is covered, the policy limits, deductibles, and any exclusions. - Compare Providers: Research different insurance providers to find the best policy for your needs and budget. - Read Reviews: Understand the reputation of the insurance provider and their claim handling process.

📝 Note: Always carefully review the policy terms and conditions before purchasing to ensure it meets your specific travel needs.

Conclusion Summarization

In summary, travel insurance is a crucial aspect of planning a trip, offering protection against a range of unforeseen events. By understanding the types of travel insurance available, what they cover, and how to choose the right policy, travelers can ensure they have the necessary financial protection and peace of mind to enjoy their journey. Whether you’re a frequent traveler or embarking on a once-in-a-lifetime adventure, considering travel insurance is an essential step in your travel preparations.

What is the primary purpose of travel insurance?

+

The primary purpose of travel insurance is to provide financial protection against unforeseen medical or travel-related expenses while traveling.

What types of travel insurance are available?

+

There are several types of travel insurance, including single-trip, multi-trip, annual, group, and long-stay travel insurance, each catering to different travel needs and frequencies.

How do I choose the right travel insurance policy?

+

To choose the right travel insurance policy, assess your travel needs, check policy details, compare providers, and read reviews to find the best policy for your needs and budget.